Let’s find you the right mortgage loan.

Start The Process

We’ll help you find a local loan originator to get you competitive rates and the programs that best fit your individual needs. Fill out this form and we’ll connect you with a lender today!

Origination Fees WAIVED

Lender Fees WAIVED

Underwriting Fees WAIVED

Loan Processing Fees WAIVED

$1,000 in Closing Cost Credits*

Very Competitive Interest Rates

BKCOloanteam.com | 844.370.9427

NMLS #6666

Ben Kinney Team with Keller Williams is not an affiliate of

Envoy Mortgage Ltd. Ben Kinney Team with Keller Williams does not endorse any mortgage lender and

encourages all consumers to shop for services when looking for a mortgage loan.

The closing

costs credit offer is for up to $1000 lender credit to any applicant for loans of $150K or more

towards third-party costs provided you fund your mortgage with the BKCO Loan Team at Envoy Mortgage

Ltd. The waived fee credit will be given in the form of a lender credit at closing up to $1495. All

applications are subject to credit approval. Program terms and conditions are subject to change

without notice. Some products may not be available in all states. Reverse Mortgages will be brokered

to a third-party lender. By refinancing the existing loan, the total finance charges may be higher

over the life of the loan. Other restrictions and limitations may apply. This is not a commitment to

lend - Envoy Mortgage Ltd. #6666 (www.nmlsconsumeraccess.org) 10496 Katy Freeway, Suite 250, Houston, TX

77043, 877-232-2461 - www.envoymortgage.com | Other authorized trade names: Envoy Mortgage LP;

Envoy Mortgage of Wisconsin; Envoy Mortgage, A Limited Partnership; Envoy Mortgage, L.P.; Envoy

Mortgage, Limited Partnership; Envoy Mortgage, LP; Envoy Mortgage, LTD Limited Partnership; ENVOY

MORTGAGE, LTD, LP (USED IN VA BY: ENVOY MORTGAGE, LTD); Envoy Mortgage, LTD. (LP) | For additional

licensing information please visit https://www.envoymortgage.com/licensing-legal-information/

We’ll help you find a local loan originator to get you competitive rates and the programs that best fit your individual needs. Fill out this form and we’ll connect you with a lender today!

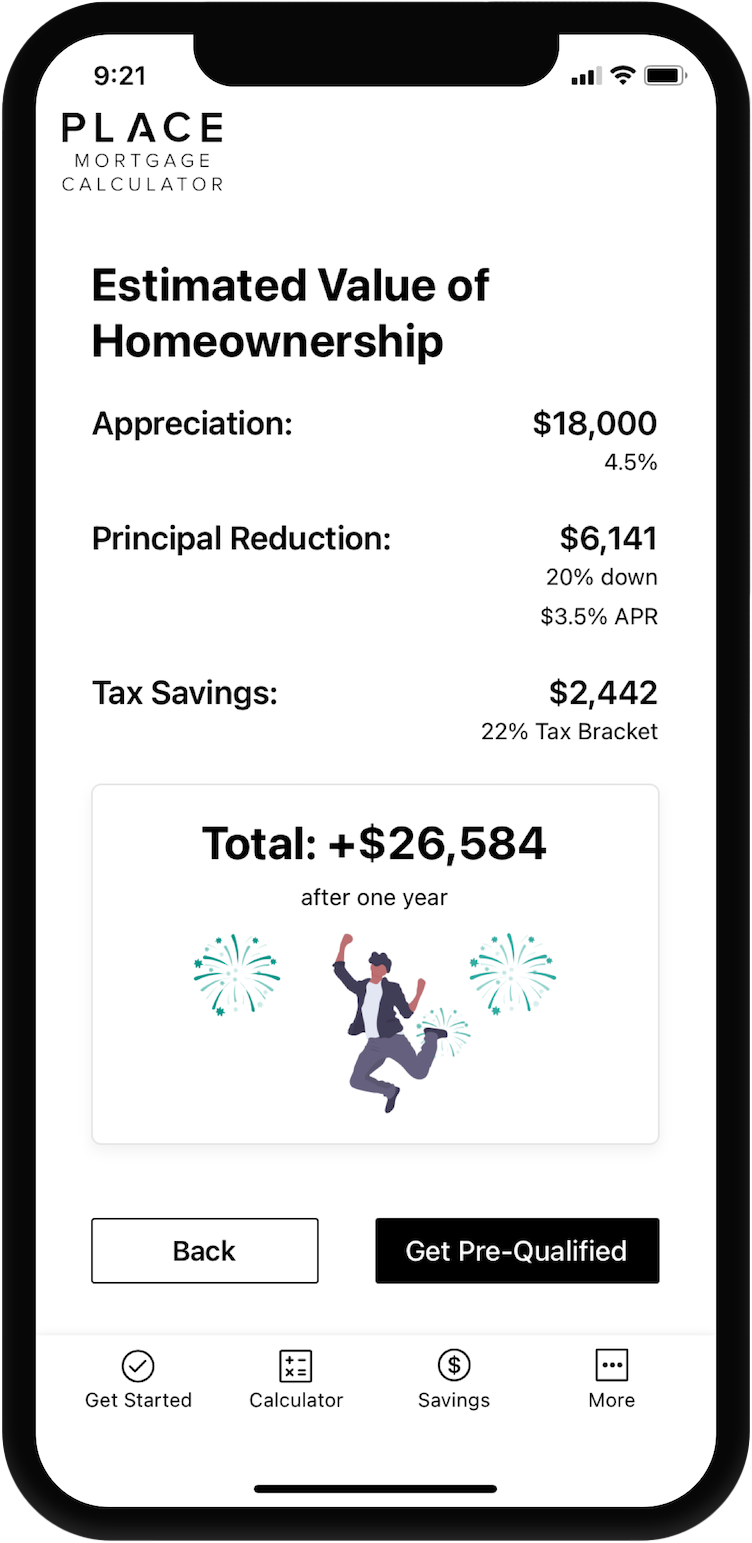

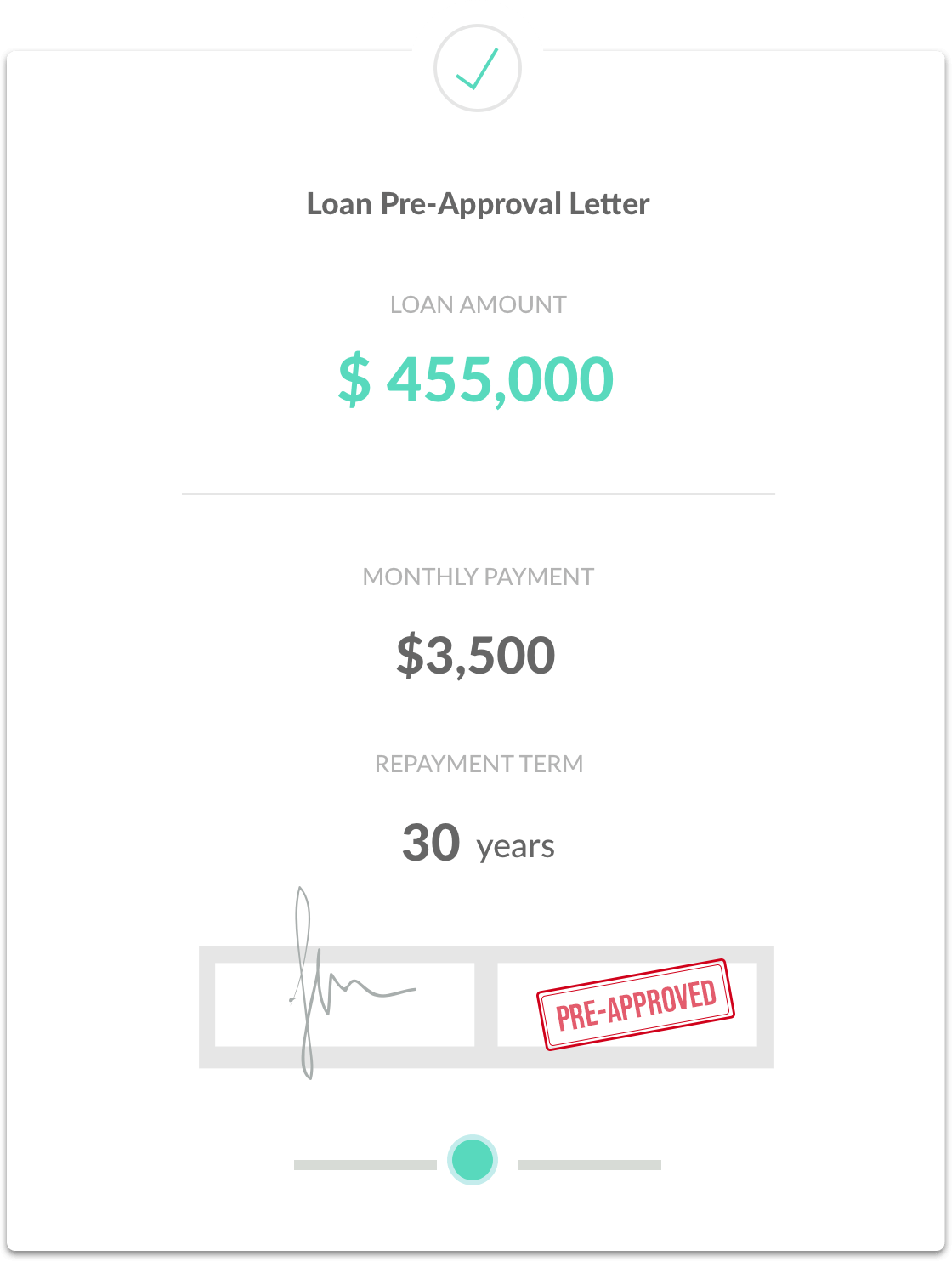

Before you start looking for a home to buy, it’s a good idea to meet with your loan originator to get pre-approved for a loan amount. At this stage, the lender gathers information about income, assets, and debts of the borrower (you) to determine how much house you may be able to afford. This includes a credit report, W-2 forms, pay stubs, Federal Tax Returns, and recent bank statements. There are a variety of different loan programs, so make sure to get pre-qualification for the specific programs that best suit your needs.

When you find property you’re ready to buy, your lender will help you complete a full mortgage loan application, and talk you through the various fees and down payment options. The application is submitted to processing, where the documents are reviewed and appraisals and title examination are ordered. Then the loan is sent to an underwriter, who reviews and approves the entire loan if it meets compliance.

Don’t be surprised if you’re asked for additional documentation or clarification throughout the process. Once your loan is approved, don’t forget to set up homeowners insurance. Your documents will be sent to the title company, where you’ll sign for the new home and pay any remaining costs. Then the loan is recorded and you get the keys. Congratulations, happy homeowner!